Through asset management and investments in various assets, insurance and occupational pension companies generate returns and profits that bene-fit policyholders. Swedish companies primarily invest in equities, investment funds, bonds, and properties. The bonds invested in by insurance and occu-pational pension companies are primarily Swedish government bonds, and bonds issued by Swedish banks and mortgage institutions.

Non-life insurance companies typically invest in assets with shorter duration compared to life insurance and occupational pension companies. This is be-cause non-life insurance companies need to manage payments of claims dur-ing the year. Life insurance and occupational pension companies have a longer investment horizon as pension and life insurance savings occur over an extended period. Similarly, the payment of pension savings also takes place over an extended period.

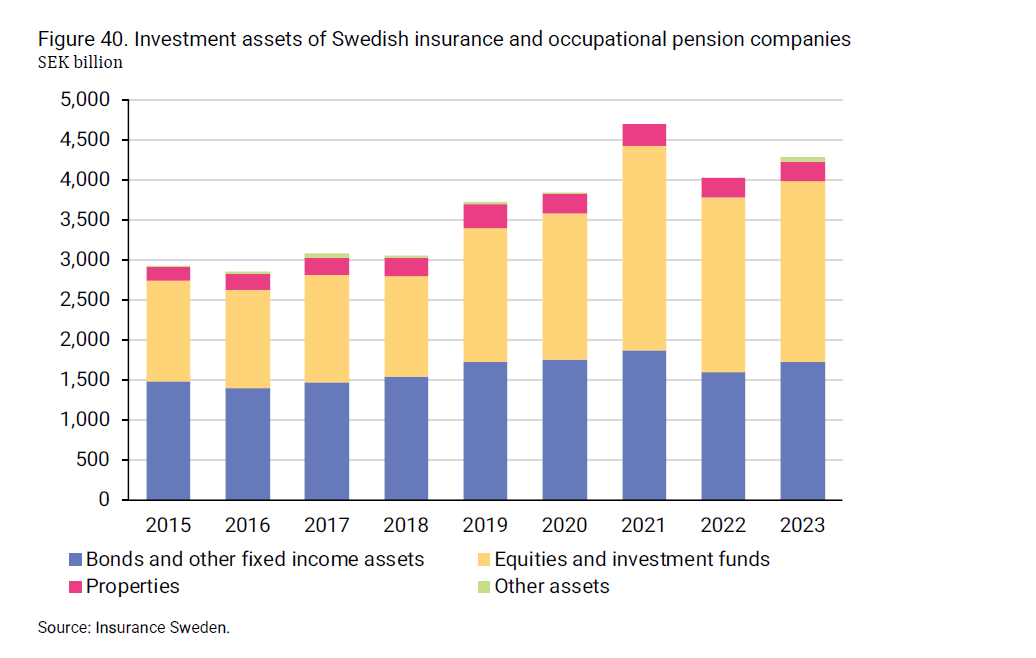

The proportion of equities and investment funds in the investment portfolio has increased since 2015 and accounted for over 53 per cent of the assets in 2023. On the other hand, bonds and other fixed income assets have de-creased and represented around 40 per cent of the assets in 2023. As a com-parison, in 2015, bonds and other fixed income assets accounted for more than 50 per cent of the assets. The increase in equities and investment funds and the decrease in bonds and other fixed income assets can largely be at-tributed to favourable developments in the stock markets and low interest rates during this period. The proportion of properties in the investment portfolio has remained relatively constant and accounted for six per cent of the assets in 2023.