Insurance premiums are paid in advance to insurance and occupational pension companies to provide insurance coverage for an agreed-upon period. This means that there is a delay between the payment of the premium and the payment of any compensation in the event of a claim or, for example, the expiration of an endowment insurance policy.

For pension and life insurance, there is typically many years between the payment of premi-ums and the payout in form of a pension or other savings. In addition to pay-ments, the premiums also cover various operating costs, such as rental ex-penses and salaries for employees in the insurance company.

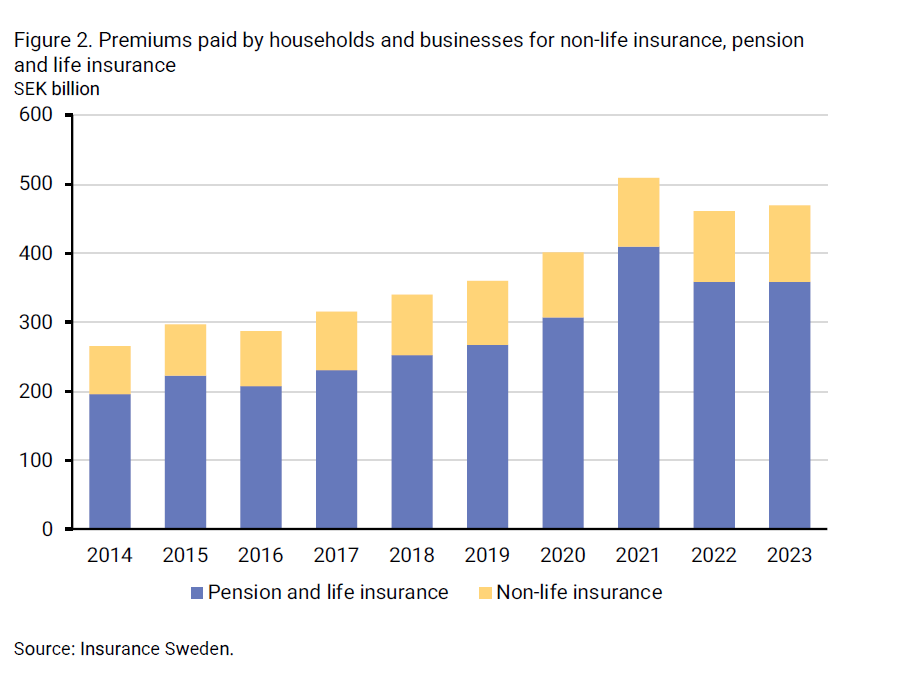

For non-life insurance, the premiums amounted to a total over 110 billion SEK in 2023, of which nearly 26 billion SEK was paid by companies and over 84 billion SEK was paid by households. For pension and life insurance, the paid premiums amounted to just under 359 billion SEK.

It is common for an individual to have multiple types of insurance, such as home insurance, motor vehicle insurance, and occupational pension. In 2023, the average premium paid per person in Sweden was approximately 8,000 SEK for non-life insurance and around 34,000 SEK for pension and life insurance. However, it is not always the individual who pays the premium. More than half (57 per cent) of the premiums for pension and life insurance are paid by employers in the form of occupational pensions. Some of the pre-miums for non-life insurance are also paid by employers, for example, cer-tain accident insurance and healthcare insurance policies.