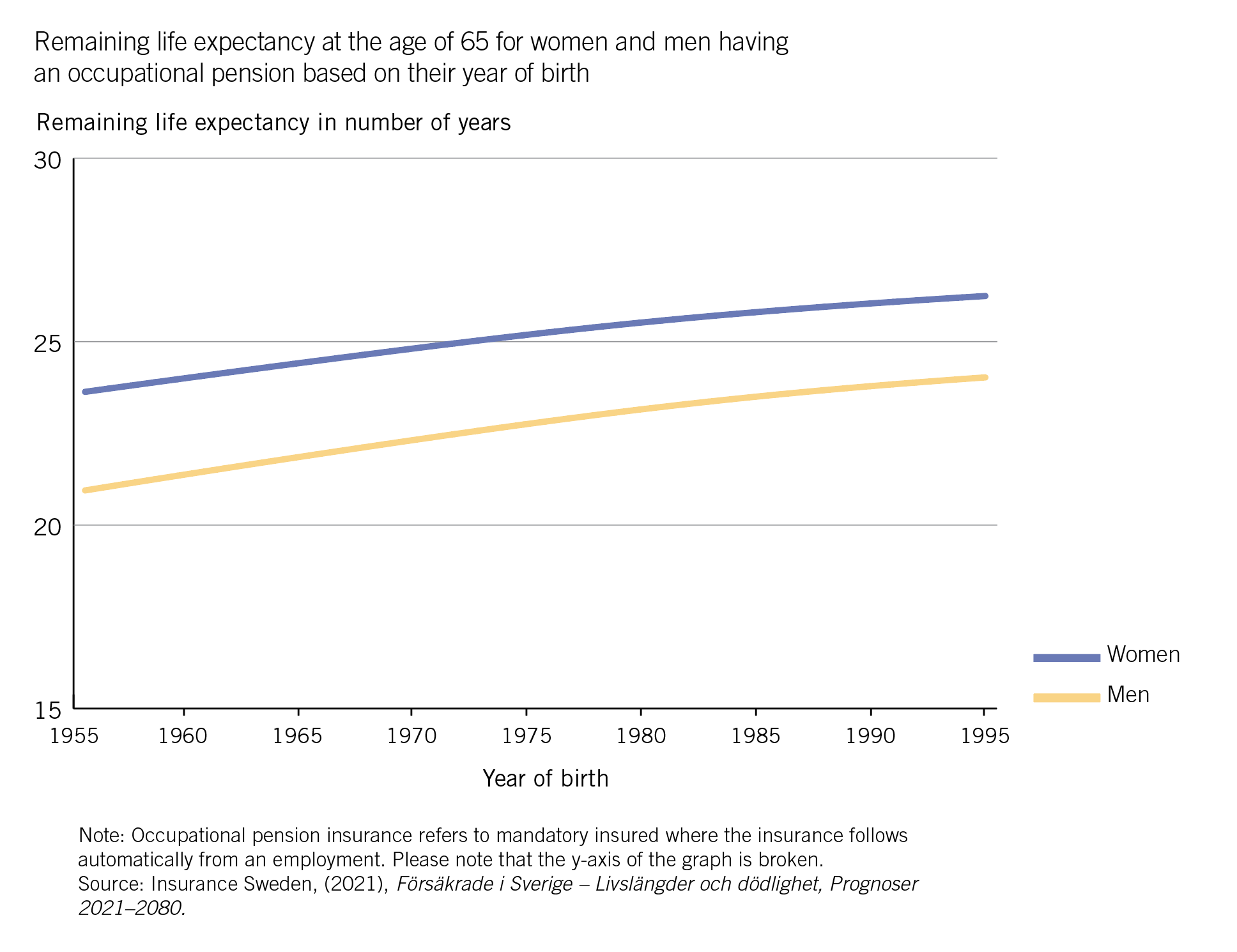

Higher savings for retirement become increasingly important as life expectancy rises. In Sweden, life expectancy is increasing, which means that pension payments need to cover a longer period for retirees, resulting in lower annual pension amounts.

For example, a woman born in 1995 with an occupational pension is expected to live an additional 26 years after reaching the age of 65, which means until the age of 91. This is over two years longer than a woman born in 1956, with an occupational pension, is expected to live after reaching the age of 65. This implies that a woman born in 1995 needs to save more than a woman born in 1956 to achieve the same annual pension, assuming the same retirement age and all other factors being equal. A similar trend is observed for men, where men born in 1995 are expected to live approximately three years longer than men born in 1956.

Furthermore, the estimated life expectancy for women is estimated to be around two years higher than that of men in the future.

In 2022, nearly 359 billion SEK was paid in premiums to pension and life insurance (see figure 33). Of these, more than half (53 per cent) was paid into occupational pensions, and 43 per cent went into private endowment insurance, which can be privately, or company owned.

Premium payments to pension and life insurance have doubled over the past ten years, and private endowment insurance accounts for 60 per cent of this increase.

Compared to 2021, premium payments to private endowment insurance have decreased from 203 billion SEK to 153 billion SEK, a decrease of 24 per cent. Both companies and individuals can save in endowment insurance, and the capital can be invested in securities and traditional life insurance. The poor performance of the stock market in 2022, along with higher prices and mortgage rates, may have contributed to the lower interest in endowment insurance.'